A2Bookmarks Norway Social Bookmarking Website

A2Bookmarks Norge er din foretrukne plattform for effektiv sosial bokmerking, designet for å heve din online opplevelse. Som verdens beste sosial bokmerkingsnettsted er A2Bookmarks tilpasset brukere som trenger å organisere, lagre og dele verdifulle nettressurser. Det tilbyr et brukervennlig grensesnitt med smart tagging og kategoriseringsfunksjoner. Koble til et nettverk av brukere for å oppdage trender og administrere dine bokmerker med letthet. Bli med i A2Bookmarks Norges fellesskap i dag for å forenkle ditt digitale liv og holde Norges mest relevante nettinnhold ved fingertuppene.

AI in Banking Using Clever Innovation to Transform Finance anavcloudsanalytics.ai

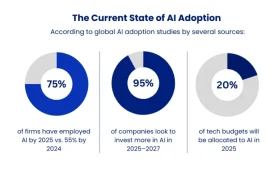

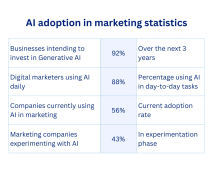

Artificial Intelligence( AI) is laboriously changing the global banking and fiscal sector; it’s no longer simply a futuristic idea. AI is helping banks optimize internal procedures and give exceptional client gests by allowing smarter, briskly, and more secure operations. AI in banking is establishing new norms for creativity, trustability, and expansion in areas like fraud discovery, substantiated backing, and prophetic analytics.

In this blog, we’ll explore how AI is revolutionizing fiscal services, the operating models banks can borrow, and the crucial technologies powering this metamorphosis.

Choosing the Right Operating Model for AI in Banking

Successful AI relinquishment in banking depends not only on the technology itself but also on the operating model chosen to gauge and manage it. Since every bank is unique in size, culture, and strategy, institutions generally follow one of four primary models

Centralized Control – A central AI platoon manages all strategy and perpetration.

Pros Faster relinquishment, harmonious prosecution, concentrated moxie.

Cons threat of dissociate from frontline operations, limited rigidity.

Central Strategy, Original prosecution – A mongrel model where the central platoon defines direction while departments execute.

Pros Balances standardization with inflexibility, ensures compliance.

Cons Requires strong collaboration, uneven prosecution speed.

Business- Led, Centrally Supported Innovation – Business units lead AI enterprise with central brigades offering guidance and support.

Pros Encourages invention at the ground position, reduces backups.

Cons Implicit inconsistencies and duplication of sweats.

Completely Decentralized Operations – Each business unit singly manages AI enterprise.

Pros Maximum inflexibility, rapid-fire trial.

Cons threat of fragmentation, spare investments, and inharmonious systems.

opting the right model ensures scalability, alignment with pretensions, and measurable results.

crucial operations of AI in Financial Services

AI is now bedded in nearly every aspect of banking. Let’s look at some of the most poignant operations

1. Enhancing Security with Fraud Detection

Banks process millions of deals daily, making them high targets for fraudsters. AI systems powered by machine literacy dissect sale patterns, descry anomalies, and identify suspicious exertion in real time. This helps help credit card fraud, phishing attacks, and identity theft before they beget damage.

2. Smarter Lending and Credit opinions

Traditional loan blessings frequently involve detainments and mortal bias. AI accelerates lending by assaying fiscal data, credit history, and client geste

This leads to more accurate threat assessments, faster blessings, and fairer lending practices.

3. AI- Driven Chatbots and Virtual sidekicks

AI chatbots give 24/7 client support, answering queries, aiding with deals, and bodying responses grounded on once relations. Unlike mortal brigades, these sidekicks scale painlessly and continuously ameliorate through literacy.

4. Market Prediction and Investment perceptivity

fiscal requests are unpredictable and complex. AI- powered prophetic analytics help banks dissect large datasets, cast request trends, and identify investment openings. Generative AI also allows fiscal institutions to model scripts and ameliorate trading strategies.

5. perfecting client Experience

moment’s guests anticipate presto, flawless, and secure services. AI makes this possible by streamlining KYC processes, automating loan blessings, and delivering substantiated product recommendations perfecting satisfaction while reducing crimes.

6. visionary threat operation

Banks face pitfalls from profitable oscillations, political changes, and unanticipated events. AI results prognosticate pitfalls beforehand, dissect client prepayment patterns, and companion institutions in making safer fiscal opinions.

7. Simplifying Regulatory Compliance

With regulations constantly evolving, compliance is grueling . AI tools powered by natural language processing( NLP) dissect legislation, examiner compliance, and flag gaps — reducing the burden on compliance officers and minimizing oversight pitfalls.

8. Anti-Money Laundering( AML)

AI- powered systems descry suspicious patterns in large sale datasets more directly than traditional AML tools. This reduces false cons while helping banks fight fiscal crimes more effectively.

9. Automating Back- Office Processes

Robotic Process robotization( RPA) streamlines repetitious tasks like data entry, document checks, and reporting. By automating these workflows, banks save time, reduce mortal error, and allow staff to concentrate on strategic precedences.

Technologies Driving AI in Modern Banking

Several advanced technologies are driving this metamorphosis

Machine literacy( ML) Detects fraud and improves credit threat analysis by spotting unusual patterns.

Natural Language Processing( NLP) Powers conversational banking with chatbots and automates document verification.

Prophetic Analytics Identifies pitfalls, vaticinations trends, and highlights deals openings.

Robotic Process robotization( RPA) Boosts effectiveness by automating primer, rule- grounded processes.

Computer Vision Enhances identity verification through facial recognition and document scanning.

Deep literacy Improves authentication and fraud discovery through advanced neural networks.

Generative AI Automates marketing, creates fiscal reports, and models unborn request scripts.

Responsible AI Ensures fairness, translucency, and ethical practices in credit and loan opinions.

Conclusion

AI in banking has shifted from being a futuristic possibility to a necessity for success in moment’s digital-first world. From fraud discovery and lending to client experience and compliance, AI is empowering banks to come briskly, safer, and more client- centric.

still, success depends not only on espousing AI technologies but also on opting the right operating model and icing responsible, ethical use.

At AnavClouds Analytics.ai, we help fiscal institutions harness AI, robotization, and prophetic analytics to achieve long- term success. However, our experts are then to guide you, If you’re ready to transfigure your banking operations with generative AI and smart robotization.

Source: https://www.anavcloudsanalytics.ai/blog/ai-in-banking/